|

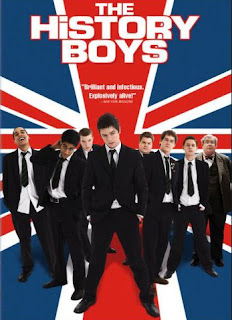

| 2006: The History Boys - Hytner |

Financial Planning comes with baggage (a lot). We have all probably had some bad experiences with money, perhaps a tale or two about being ripped off. Childhood experiences of money - right from our family approach to reward and affirmation to the holidays we took and our pocket money budgeting skills (or lack of). In essence our experience of money in our formative years invariably provides the backdrop for our adult experience. Our relationship with money is complex and I am always intrigued by it.

This weekend was a family celebration for my family. We decided to meet up in the west country, where I grew up. I had booked a B&B for the weekend, and rather surprised to find my old History teacher welcome us inside (thankfully History lessons and exams hold good memories for me). We met up with several long-term family friends, many of whom I had not seen for over thirty years, yet the memories came flooding back. Its funny what we can remember. I was aware of how much I had changed, but also how my own childhood seemed so relatively simple. It also seemed that life was also much more straight-forward. Most people probably had little if any financial planning back then, financial products were certainly fewer and appeared to be quite simple (from today's perspective). Now there is a huge amount of complexity and potential for disaster from an enormous array of financial products. Yet, the reality is that little has really changed. Today people want what they wanted then - a life that involves enjoyment, fulfilment, meaning, and as little anxiety as possible. Yet we seem to have complicated this to the point of paralysis with information overload. Things change - most obviously in the purchasing power of a pound (which was a paper note in my childhood). It was amusing to listen to my brother attempt to explain inflation to his son - which of course is often explained in terms of the price of sweets.

However, the past is the past. It is the backdrop, it is not our future. Certainly the predictability of domestic family life has an element of repetition. It has lessons to teach us and warnings to heed as well as reminding us of our roots and providing a "grounding". However, the role of a good financial planner is to help make the complex rather more simplified. To keep the focus on what is important to you (not the market and certainly not the media). Predicting the future is folly, we all know that life can deliver an unhelpful curve ball or two, however, being prepared, being able to know what you value not "what your valued" can have a very liberating and anxiety reducing effect. To your future!

No comments:

Post a Comment